Indicators on Ia Wealth Management You Should Know

Table of ContentsPrivate Wealth Management Canada for Dummies7 Easy Facts About Independent Investment Advisor Canada ShownAll About Independent Investment Advisor CanadaPrivate Wealth Management Canada Can Be Fun For AnyoneMore About Financial Advisor Victoria BcNot known Incorrect Statements About Retirement Planning Canada

“If you're purchase a product, state a television or a personal computer, you might wish to know the specs of itwhat are its parts and exactly what it may do,” Purda explains. “You can think of buying monetary information and help in the same way. People must know what they are purchasing.” With monetary information, it is important to understand that the merchandise isn’t securities, shares or any other investments.

it is such things as cost management, planning pension or paying down financial obligation. And like purchasing a personal computer from a dependable company, customers wish to know these are typically purchasing monetary information from a trusted expert. Among Purda and Ashworth’s most interesting conclusions is just about the charges that monetary coordinators charge their clients.

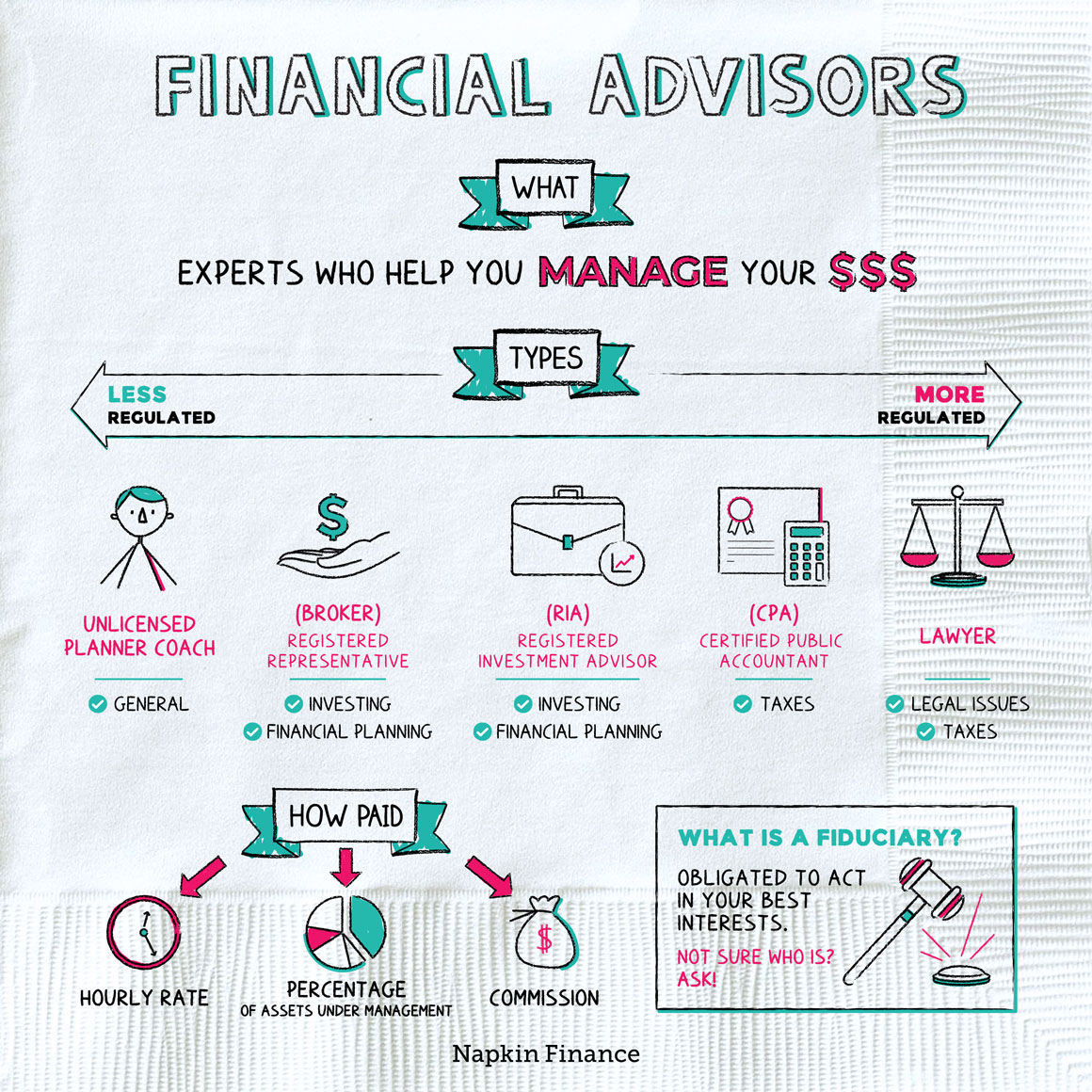

This conducted true regardless of the cost structurehourly, fee, assets under administration or flat rate (inside the learn, the buck property value fees was actually equivalent in each situation). “It however relates to the worth proposition and uncertainty from the customers’ part that they don’t understand what these are typically getting in trade for these charges,” claims Purda.

Facts About Investment Representative Uncovered

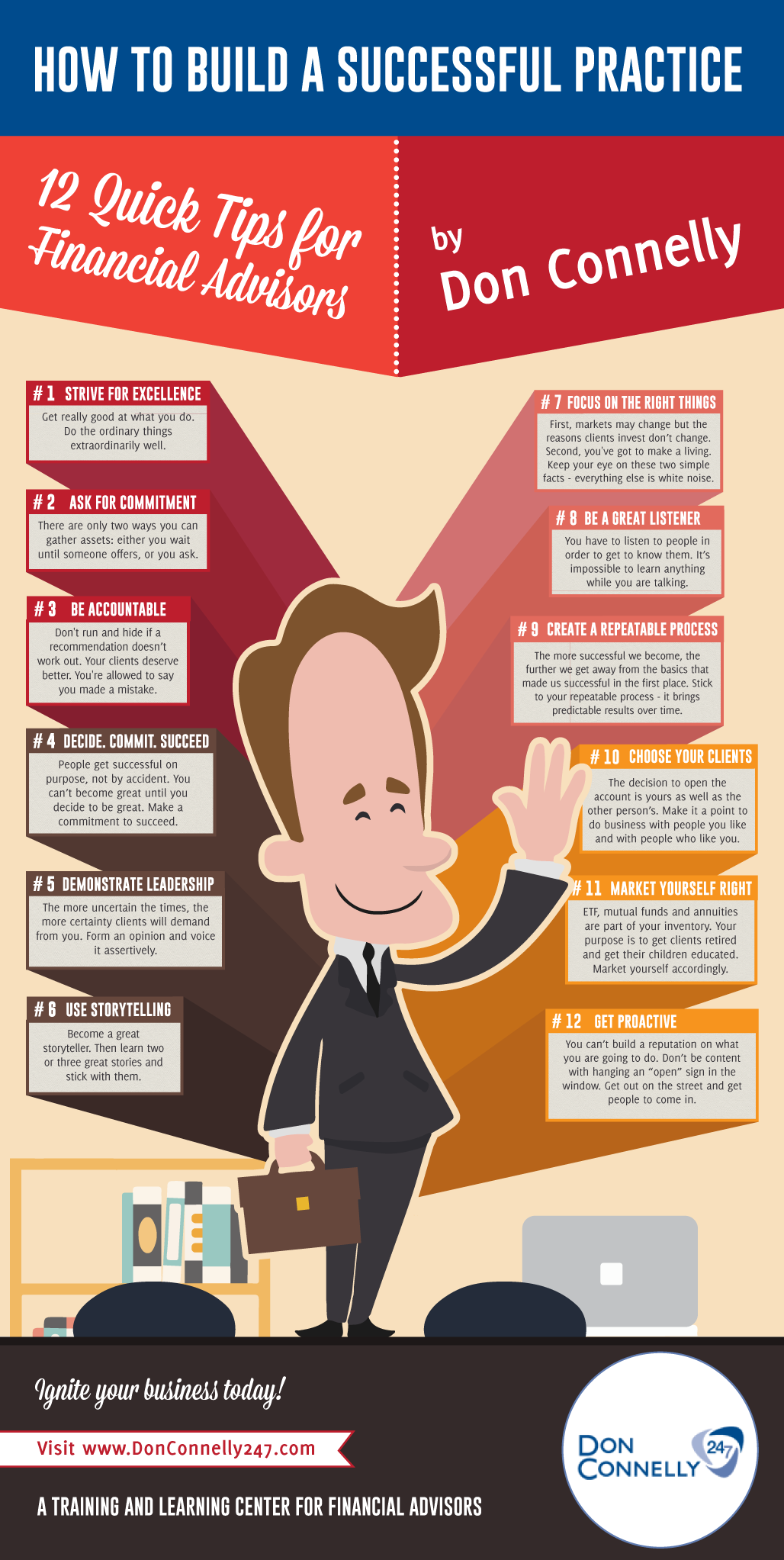

Tune in to this particular article whenever you notice the phrase economic advisor, what pops into the mind? A lot of people think of a specialist who are able to provide them with economic information, specially when it comes to investing. That’s a fantastic starting point, however it doesn’t paint the complete image. Not really near! Economic experts can help people with a bunch of other money goals as well.

An economic consultant will allow you to build wide range and shield it for your long lasting. Capable approximate your own future financial needs and strategy how to extend your own pension savings. They may be able in addition help you on when you should begin tapping into personal safety and ultizing the money in your retirement records to abstain from any horrible penalties.

The Best Guide To Investment Consultant

They could guide you to decide exactly what mutual funds are best for your needs and demonstrate how exactly to manage and work out more of your investments. They may be able additionally let you see the threats and just what you’ll ought to do to attain your aims. A seasoned financial investment expert can also help you remain on the roller coaster of investingeven if your investments just take a dive.

They could provide direction you need to create plans to help you be sure that desires are carried out. Therefore can’t place a price label from the peace of mind that include that. According to a recent study, the common 65-year-old few in 2022 should have about $315,000 saved to pay for medical care prices in your retirement.

The 4-Minute Rule for Financial Advisor Victoria Bc

Given that we’ve reviewed exactly what economic analysts do, let’s dig to the a variety. Here’s a good guideline: Continued All economic planners are economic advisors, although not all analysts tend to be coordinators - https://www.domestika.org/en/carlosprycev8x5j2. A monetary planner focuses primarily on assisting men and women make plans to achieve long-term goalsthings like beginning a college fund or preserving for a down repayment on a home

So how do you understand which economic expert is right for you - https://lwccareers.lindsey.edu/profiles/4232859-carlos-pryce? Listed below are some steps you can take to make certain you are really choosing ideal person. What do you do if you have two bad options to choose from? Effortless! Get A Hold Of a lot more choices. The greater number of solutions you have got, the much more likely you happen to be which will make an effective choice

The 7-Minute Rule for Independent Financial Advisor Canada

Our very own Intelligent, Vestor system makes it possible for you by revealing you around five monetary advisors who is going to last. The good thing is actually, it is completely free in order to get linked to an advisor! And don’t forget to come quickly to the interview ready with a list of questions to inquire about in order to figure out if they’re a good fit.

But listen, just because a consultant is actually wiser than the typical bear doesn’t let them have the authority to reveal what to do. Sometimes, experts are full of on their own since they do have more levels than a thermometer. If an advisor begins talking-down for your requirements, it is for you personally to demonstrate to them the doorway.

Just remember that ,! It’s important that you along with your economic consultant (whomever it ends up getting) take equivalent page. You prefer a specialist having a long-lasting investing strategysomeone who’ll promote you to definitely hold trading consistently whether the market is up or down. retirement planning canada. In addition, you don’t want to use a person that forces you to invest in something’s as well dangerous or you’re unpleasant with

Fascination About Tax Planning Canada

That combine will provide you with the diversity you will need to effectively invest for the longterm. Whilst study economic experts, you’ll most likely come upon the word fiduciary task. All this work implies is actually any consultant you hire must act such that benefits their own customer and never their particular self-interest.

Comments on “How Lighthouse Wealth Management can Save You Time, Stress, and Money.”